As the President and Chief Operating Officer, Philip Harlow is driving XTAR’s business and operational growth to fulfill the company’s strategic mission.

Mr. Harlow focuses on creating new business opportunities while maintaining the company’s competitive positioning at the forefront of the government, military and civil satellite communications business. As leader of the management team, Mr. Harlow has developed new company and performance objectives and is accountable for all of XTAR’s critical engineering, operations, marketing and sales initiatives.

Mr. Harlow honed his management skills at DRS Technical Services as Vice President of Engineering and Technology, leading their satellite, terrestrial and enterprise network development. Previous to this position, Philip led engineering, business development and sales engineering for several satellite operators serving customers worldwide. Prior to XTAR, Mr. Harlow was Chief Technology Officer for CapRock Communications where he drove all aspects of engineering, IT, infrastructure development, new product management and strategic planning.

Mr. Harlow holds an honors degree in electronic systems engineering from the Royal Military College of Science and an MS in systems engineering from George Washington University.

MilsatMagazine

Mr. Harlow, please describe the overall role MILSATCOM plays within mobile communications for the military. What role does X-band play within this environment?

Philip Harlow

Over the past decade, data has become a critical force multiplier in military operations with users demanding ever faster broadband speeds to smaller and more mobile terminals. Between advances in the performance of users terminals, and better utilization of satellite bandwidth, providing broadband speeds to mobile users has become increasingly more cost effective.

Operators of Fixed Satellite Services (FSS) satellites, which have traditionally utilized an infrastructure model—that is, fixed sites set for long-term use—are transitioning to meet this demand for increased mobile services.

In addition, we’ve see an accelerated across-the-board move from traditional Mobile Satellite Services (MSS) use as the predominant satellite service for mobile users, to a pervasive broadband culture, with ever-increasing data rates.

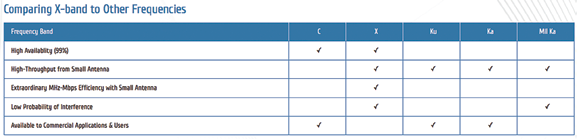

Commercial FSS satellite operators need to provide the necessary bandwidth support wherever our military forces are operating around the world. Ku-band and Ka-band, although widely adopted to serve mobile applications, have a couple of inherent technical challenges. For example, rain fade issues will continue to plague both frequency bands, and once more Ka-band satellites get to orbit, we’ll see the same issues with adjacent satellite interference as we do today at Ku-band.

In comparison, commercially available X-band, such as XTAR delivers, does not suffer from either of these technical handicaps. I predict that the use of commercial X-band to serve the mobile government user will accelerate as decision-makers experience the enormous benefits available from X-band. Certainly, XTAR has been enjoying enormous success supporting mobile users over the past couple of years.

MilsatMagazine

If demands for increased network capabilities translate into growing reliance on satcom, how can the military meet those needs?

Philip Harlow

The broadband satellites that are being manufactured for the military, Wideband Global SATCOM (WGS) as an example, are not well suited to support the communications requirements of growing mobile networks. With few exceptions, the X-band on those systems is currently utilized mostly for static sites—a misuse of the great versatility of X-band, in my opinion—while many military users are pinning their hopes on the military Ka-band spectrum they have on their satellites. The newcomers to the FSS marketplace, who are bringing vast quantities of Ka-band (both military and commercial variants of Ka-band spectrum) are spending a great deal of time trying to sell their product to the Department of Defense (DoD) to fill this need.

I believe that Ku-band will continue to fill a need, but find a more comfortable home serving more established, static network applications, where larger antennas are acceptable, and star and mesh network topologies are more prevalent.

The real unknown factor is the status of the unmanned aerial vehicles (UAV) fleets. Today, their communications packages are based almost exclusively on Ku-band—really the only solution available at the time those platforms were designed—but the future could see a migration to Ka-band. That migration is not a cost-free undertaking—changes of scope on programs-of-record are seldom inexpensive—so use of Ku-band for these platforms could continue for the medium to long-term.

MilsatMagazine

How do you believe the DoD will deliver communications capabilities into the future? Where do commercial operators come into play?

Philip Harlow

We’ve heard from several military leaders that commercial satellites are an integral part of the architecture for military satellite communications needs. One would assume that this means that commercial capabilities are being taken into account when military planners look at their fleet replacement strategy over the next five to 10 years. The industry hasn’t seen this in any official form, yet, but it is clear that commercial satellites will continue to play a significant role for the military for many years to come.

Let’s examine this. To use their own satellites constellation, DoD would need to retrofit the communications packages on the UAV fleets to a military frequency. The likelihood of DoD gaining access to orbital filings at Ku-band is practically zero, as commercial operators are unlikely to give up such valuable real estate rights. Perhaps more significant, the DoD would have to put many additional satellites into orbit, or very large satellites, perhaps High Throughput Satellites (HTS), to accommodate the number of active UAVs in addition to supporting current operational data networks.

Nevertheless, to rely on commercial satellites for such a critical mission would require DoD to acknowledge that commercial satellites are key partners in the architecture, and force a positive statement to that effect. A true partnership and collaborative effort would be required between DoD and the commercial satellite operators, however this potential partnership currently lacks formal DoD support in the form of an official architecture.

MilsatMagazine

What are the most important mobile communications technologies for the military end-user?

Philip Harlow

What drives the need for mobile connectivity in the battlefield are the increasing number of applications that are proving useful, even critical, for those military personnel deployed across the globe. Mobile communications has come of age over the past decade, particularly evident with the real-time intelligence, including video and sensor data that UAVs have made readily available and necessary for the military to conduct their missions.

The desire for more applications, and the increased use in mobile environments will continue to drive demand, allowing satellites to play a significant role in providing the connectivity for mobile users. This is already having a dramatic impact on terminal manufacturers and on commercial satellite operators. Current terminal innovations are smaller and lighter to support the mobile user. They are using less power, and are achieving higher and higher data rates. Modems are getting better and better at coding and modulation. All of this has resulted in higher adoption of mobile terminals, which is in turn driving the need for more appropriate bandwidth for mobile users.

Satellites capabilities are expanding exponentially with more powerful transponders that utilize greater bandwidth with the ability to provide service into smaller terminals with greater efficiency. Both satellites and terminals have a ways to go before users can carry a mobile terminal on his shoulder and have always-on broadband communications, but innovations in terminal mobility have already witnessed significantly strides from just five years ago.

The applications in use, and those coming into use, need to increase resiliency to integrate satellites as the main communications path. Latency, interference, blockage and weather can cause dropped packets or loss of connectivity, either instantaneous or for longer periods of time. These applications need to be able to cope with the operating environment in which they will be used, without imposing restrictive limits on their effectiveness.

MilsatMagazine

How do you think the DoD can address the lack of Ku-band to meet the growing UAV demands?

Philip Harlow

If you ask the Ku-band operators, I think they will refute there is a shortage of Ku-band capacity to meet these needs, now, or in the future. The major Ku-band operators, as well as many regional players, are replacing their older satellites with much more capable units. In every case, we see an increased in the numbers of transponders and greater coverage areas at higher power and commercial operators have never failed to rise to the challenge, to bring effective capacity to bear when and where needed.

The issue is the uncertainty of DoD requirements, which are often short-term in nature and procured over congested regions at short notice. This means capacity is in short supply at a greater expensive. With a little planning, there should be no shortage of appropriate capacity at Ku-band, particularly as we withdraw forces from Afghanistan and the transponders used to support those troops are reallocated to UAV missions running on Ku-band.

However, if you want to assure that Ku-band will be available at the right place, at the right time and at reasonable costs, then DoD has to work more closely with the satellite operators. Often DoD states that they already do this, but I can attest that the relationship is often that of user and supplier. There is little real collaboration that would enable the commercial satellite operators to plan effectively. The legwork that is needed to coordinate with other customers, to groom transponders and to get capacity available in beams where there are multiple users cannot be done in a vacuum.

The Pathfinder initiatives, spearheaded by the Air Force Space and Missile Systems Center (SMC), are a step in the right direction with the desired outcome to test contracting and operational mechanisms to improve the collaboration between the commercial industry and the DoD user base they serve.

Pathfinder 1 was the procurement of Ku-band transponders until end-of-life of a satellite over North Africa. This has proven a huge success enabling cost-savings with prices 75 percent less than standard procurement practices.

Pathfinder 2 is in the works and focused on procurement of pre-launch transponders. If the request for information (RFI) is anything to go by, we can expect several additional pathfinders in the future.

These pathfinders will help, but we will still need a shift within DoD in their relationship with the commercial operators to view them as more than simple vendors, but as trusted partners, with both satellite operator and DoD user equally vested in the success of the mission. We still have a long way to travel on that road.

MilsatMagazine

What special advantage in mobile communications does X-band provide to the end user?

Philip Harlow

X-band is a particularly interesting frequency band. It is designated by the International Telecommunications Union (ITU), a United Nations Regulatory Authority that is responsible for international frequency band allocations for all satellite systems, for use exclusively by governments worldwide. Each country decides how to utilize this band.

For many western countries, the regulatory authorities (in the case of the United States, the Federal Communications Commission) further restrict the use of X-band for the military. In other countries, such as New Zealand, the frequencies are used for cellular backhaul or, as in Germany, for microwave terrestrial telecommunications links. Users are government only, which means more stable and secure control over the spectrum.

There are a number of technical performance advantages from X-band. Most notably, X-band suffers very little rain attenuation, a function of the specific operating frequencies—it simply performs well in poor weather conditions that would adversely affect all Ku-band and Ka-band links.

Another key difference from X-band’s commercial counterparts is that there are few adjacent satellites—those that are nearby are at least 4 degrees away. This means there is little to no adjacent satellite interference and less noise, so links perform better. The remote antenna size can also be smaller, often much smaller than Ka-band could effectively use. A smaller antenna results in a larger beam width meaning that a smaller antenna has the potential to spread its signal to adjacent satellites more easily. However, with no adjacent satellites, or satellites spread further apart than most Ku- and Ka-band systems, X-band terminals can operate free of this limiting factor.

MilsatMagazine

With potential for X-band orbital slots around the globe, what do you think needs to happen to see countries taking more advantage of this resource, either nationally or commercially?

Philip Harlow

As the resource is limited to government use only, I see little exploitation outside of a small, select number of countries and commercial companies. In this, I am totally aligned with many in the military who have no desire to see this frequency band awash with more satellites. A number of technical and coordination challenges would be introduced that the frequency band currently avoids. If X-band were as congested as Ku-band is currently, and as Ka-band is going to become, it would lose a large part of its value proposition as well as many of its technical advantages.

Where I do see an opportunity to exploit X-band further is in the introduction of HTS-like satellites at X-band. This would mean more capacity in the sky while maintaining the separation between satellites and the exclusivity for government users.

MilsatMagazine

What do you foresee as the future for X-band?

Philip Harlow

When I talk with some counterparts of DoD, there is a significant reluctance to see the frequency band exploited further. However, there is no doubt that the message is getting out there. We see increased interest among the technical and cost advantages that can be realized in X-band. If DoD would get behind XTAR, we would be able to save DoD a lot of money and improve performance significantly for all users.

DoD is banking on military Ka-band to support all its future mobility needs. I don’t believe that this is the right approach. X-band has shown itself to be so efficient at serving mobile users, I would advocate for an increase in the amount of commercial X-band being made available to the military, particularly to those whose applications are mobile in nature.

Ka-band is much more suited to point-to-point applications where the antenna sizes can be optimized and factors such as rain-fade can be accounted for in performance analyses. If we turn the current thinking on its head, we would find a large number of customers better served by X-band for mobile applications, and static applications would be well served by Ka-band. In the long run, I believe this is a more logical and technically sound approach.

I see a very positive future for X-band, and particularly for the commercially available X-band that XTAR provides. XTAR is planning expansion into the Pacific region in the near- to medium-term future, as political instability and the potential for natural disaster threaten the region, as well as a desire to operate globally by several of our current and prospective customers. We see users extremely concerned about the potential impact on Ka-band services due to the atmospheric conditions prevalent in that region— X-band represents an excellent alternative for them.

For information regarding XTAR, please visit: http://xtar.com/